What Is Full-Time Equivalent (FTE)?

-

Kate Borucka

- 2024-04-18

- 6 min read

Full-time equivalent (FTE) is one of the key metrics that can help to better manage time, resources, and plan budget. It’s used across all industries in different businesses and can be a helpful tool in project management.

Here’s your short guide to full-time equivalent (FTE), why it’s important to know it, and how to calculate it.

What Is FTE?

Full-time equivalent (FTE), or whole time equivalent (WTE), represents the total workload of an employee, expressed in terms of full-time hours. It standardizes the varying hours worked by employees into the equivalent of a full-time position.

It’s a unit of measurement that specifies the ratio of hours worked by an employee to hours worked by other employees in a company. In more general terms, it’s about how many full-time employees you hire.

When we talk about FTE, we’re trying to measure how much work someone does (usually hourly employees) compared to a full-time employee.

A full-time equivalent value of 1.0 represents a full-time employee working standard hours (typically 40 hours per week), while a value of 0.5 indicates an employee working half of those hours. That calculation makes it easier to compare workload between different employment arrangements.

Here’s an example to illustrate:

Imagine you have two employees. One works full-time, putting in 40 hours per week. The other works part-time, putting in 20 hours per week.

Now, if we want to compare their workloads in a way that makes sense, we can use FTE.

For the full-time employee, it’s easy. They’re already working the standard full-time hours, so their FTE value is 1.0.

For the part-time employee, since they’re only working half the hours of a full-time employee, their FTE value would be 0.5. This means they’re equivalent to half of a full-time employee in terms of workload.

So, when we talk about FTE, we’re essentially converting different work hours into a common measurement, making it easier to compare the workload of employees who work different hours.

Why Is Full-Time Equivalent Important?

FTE calculations are crucial for various purposes, including determining staffing needs, budget allocation, and assessing productivity levels within an organization.

The main purpose of FTE is to standardize and compare the workload of employees across different employment arrangements, such as full-time, part-time, or temporary positions. This helps to effectively manage workforce, allocate resources, and make informed decisions regarding staffing levels and budgeting.

Here’s how being aware of full-time equivalent in your company can help you:

Resource Allocation

FTE helps organizations allocate resources effectively by determining how many full-time employees (FTEs) are needed to fulfill certain roles or tasks. This information is useful in budgeting and planning.

Cost Management

Understanding the FTE count enables businesses to manage costs more efficiently. It helps in calculating labor expenses, benefits, and other associated costs accurately.

Also, it helps to determine all employee costs and expenses.

Read more: Understanding the Exact Cost of an Employee

Workforce Planning

FTE allows employers to plan their workforce strategically. By knowing the number of FTEs required for different projects or departments, you can ensure you have the right staffing levels to meet demands.

It also helps in determining what types of employees are needed: full-time workers or part-time employees.

Performance Measurement

FTE metrics can be used to measure the performance and productivity of teams or departments. It provides insights into how efficiently resources are utilized and whether adjustments are needed.

Comparative Analysis

FTE data allows to compare staffing levels with industry benchmarks or competitors. This comparison helps in identifying areas of improvement or opportunities for optimization.

Compliance and Reporting

Many regulatory requirements and reporting standards necessitate the calculation and reporting of FTEs. Adhering to these standards ensures compliance and transparency in financial and workforce reporting.

How to Calculate FTE?

Calculating FTE is easy. But to do it accurately, you need to include all the important factors.

Here’s a breakdown of how to calculate it:

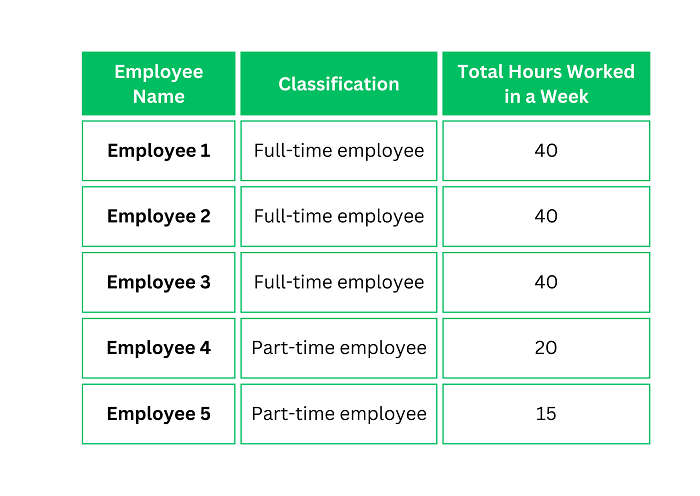

Step 1: List all employees and hours worked

First of all, prepare a list of all your employees. You can use the W-2 form (Wage and Tax Statement) or timesheets from the previous calendar year for important information about employee data.

You need to determine the total number of your employees, including both full-time and part-time workers. You’ll also need the number of hours worked by each employee within a year.

Note: Remember not to include the 1099 workers. These are self-employed people such as individual contractors, consultants, freelancers, or gig workers.

Example:

PRO TIP: Want to accurately track hours worked? Use TimeCamp, free time tracking software to calculate employee time precisely for all types of employees.

Try best time management app!

Free time tracking & easy attendance, project profitability analysis and precise billing.

Step 2: Determine full-time and part-time work hours

Establish the standard number of hours constituting a full-time workweek in your organization. Also, define what number the company considers as part-time.

A full-time is typically 40 hours per week, but it can vary depending on industry or company policy.

You’ll need this to make a distinction between hours worked by full time employees and part time employees.

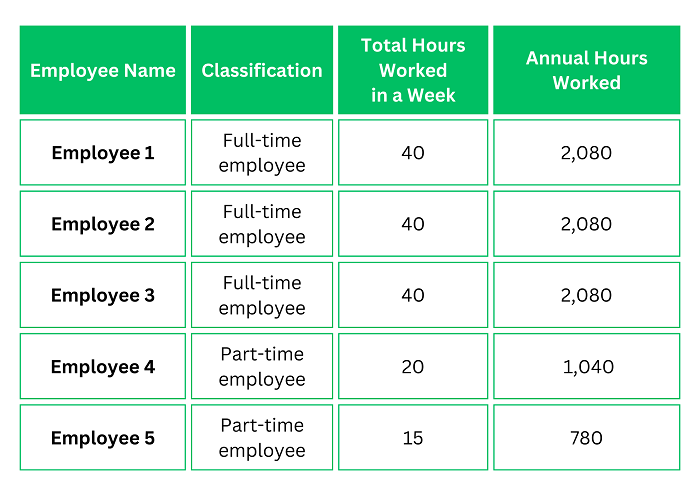

Step 3: Calculate annual hours worked

Multiply the full-time work hours per week by the number of weeks in a year (52 weeks) to obtain the annual hours worked for full-time employees.

For example, if full-time employees work 40 hours per week, the calculation would be:

40 hours/week * 52 weeks = 2,080 hours/year.

To calculate the annual hours worked for a part-time employee, multiply the number of hours worked per week by the number of weeks worked in a year.

For example, if a part-time employee works 20 hours per week for 50 weeks, they would work a total of 1000 hours annually.

Step 4: Add annual total hours worked for all employees

Now, add up the actual hours worked by full-time employees and the total hours worked by all part-time employees. It’ll give you the annual total hours worked by all your employees.

Example:

- Full-time employees (1-3): 3×2,080=6,240

- Part-time employees (4-5): 1,040+780=1,820

Step 5: Determine part-time FTE

To calculate part-time FTE, you need to divide the sum of all part-time hours by the sum of hours worked by one full-time worker:

Part-Time FTE = Part-time hours/Full-time hours in a company

Example: In our example, the part-time FTE will be 1,820/2,080=0.875

Step 6: Calculate the total full-time equivalent

Finally, sum all total hours worked by part-time and full-time employees.

Remember, that for each full-time employee, the FTE is 1.0. Since we have five employees, three of which with 1.0 FTE, the FTE for all full-time workers will be 3.0. The part-time FTE is 0.875.

Hence, in our example, the total full time equivalent will be:

3.0 (full-time FTE) + 0.875 (part-time FTE) = 3.875

Step 7: Interpret the Results

The resulting value represents the number of full-time equivalent employees.

So, if the calculation yields 3.875 FTEs, it means that the workload of your part-time employees is equivalent to that of 3.875 full-time employees.

Perform this calculation regularly to track changes in your workforce composition and ensure adequate staffing levels.

Also, include all employees, whether full-time or part-time, in your FTE calculation. Exclude contractors or freelancers who are not considered employees.

FTE and Federal Laws

When it comes to the law, understanding FTE can be crucial for compliance, particularly in areas such as labor regulations, taxation, and healthcare.

For instance, in the context of labor laws, FTE might come into play when determining eligibility for benefits, overtime pay, or compliance with minimum wage requirements. Some laws might specify thresholds based on the number of FTEs employed by a company.

In taxation, FTE calculations can influence the classification of businesses for tax purposes. The Affordable Care Act (ACA) uses FTE calculations to determine whether a business is subject to the employer mandate, which requires certain employers to offer health insurance coverage to their employees.

Moreover, FTE can also be relevant in areas such as eligibility for certain government programs or grants, where an organization’s size, as measured by its FTE count, might determine its eligibility or the amount of funding it receives.

Overall, understanding FTE and its implications within the legal framework is essential for businesses to ensure compliance with relevant laws and regulations.

Conclusion

Understanding and accurately calculating full-time equivalents can help your business optimize its workforce management strategies. This will allow you to make informed decisions regarding staffing levels, resource allocation, and budget planning.

What’s more, by analyzing data collected through time tracking software, you can gain valuable insights into employee productivity trends, peak performance hours, and potential bottlenecks. It can help you save time and resources, enhance efficiency, and drive greater profitability.

Get to know where your time goes with TimeCamp!

Track time in projects and tasks, create reports, and bill your clients in just one tool.