How to Keep Track of Business Expenses: Tips & Tools

-

Kate Borucka

- September 24, 2024

- 11 min read

Beware of little expenses. A small leak will sink a great ship. — Benjamin Franklin

With the right tool, keeping track of expenses will help you organize business finances, easily record income, and monitor cash flow. You’ll make smarter business transactions and ensure business continuity.

How to track expenses and make sure you’re doing it the right way, why is it important, and what are the best tools? Here’s everything you need to know about tracking business expenses.

Why Keep Track of Business Expenses?

Financial stability of your business is motivated by how well you manage expenses, bookkeeping, and accounting. It also depends on many other factors such as the industry you work in, the niche you’re aiming at, or the state of the economy in a given period of time.

But one of the crucial factors of ensuring business continuity and financial health is expense tracking. It allows you to control cash flow and make sure all numbers add up.

Take a look at all the benefits of tracking your spending:

- It’s easier to organize finances.

- Tracking expenses ensures clarity—you can see how much money is flowing through your business, and see the ratio of spending to saving.

- It’s easier to manage taxes and be prepared for tax time.

- A proper accounting system guarantees law compliance.

- You get accurate financial statements.

- It helps to avoid debt and overspending.

- You can more easily achieve your financial goals.

- It’s possible to spot fraudulent activity in your company.

A story of precaution: Woolworths is a classic example of a company that struggled due to poor financial management, including letting expenses get out of control. Woolworths, once a beloved retail chain in the U.K., faced significant financial difficulties leading to its collapse in 2009. The company struggled with mounting debts and was unable to adapt to changing market conditions and consumer preferences.

The financial mismanagement included overexpansion and an inability to control operational costs effectively. Woolworths failed to modernize its business model and could not compete with more agile and innovative competitors. This lack of financial discipline and strategic foresight ultimately led to its downfall, resulting in the closure of all its stores and significant job losses.

Overall, tracking your expenses can help you be more accountable and make better financial decisions.

Read also: Learn How to Keep Track of Time and Work Hours

How to Effectively Keep Track of Business Expenses?

Expense tracking can be difficult, especially for small businesses or freelancers. While dedicated departments handle financials in large organizations, it becomes more challenging for a small business.

There are, however, measures that you can adopt to make tracking your expenses a breeze. Here are the 8 tips for effective small business expense management.

1. Open a business bank account

Defining a boundary between personal expenses and business costs may be tougher when you keep them all together. Having separate bank accounts can make a big difference. It’ll help keep your expense report neat and you’ll be able to easily access your data.

Additionally, having a business bank account for business-only obligations will ensure you stay legally compliant, especially if you’re a freelancer or an owner of a small business.

And there are many other benefits of having a business bank account:

- Always accurate bank statements.

- Proof of business purchases.

- You have a dedicated debit card or business credit card.

- You can accept credit card payments easliy.

- No need to spend extra hours separating paper receipts or looking for particular transactions.

- With the bank account, you are better prepared for tax season.

- Often, it’s easier to get business credit in necessary situations when you have a business bank account.

With a dedicated bank account, you always see your bank statement—it’s the best way to keep financial transparency. Engaging a financial software development company can also help by providing custom tools for real-time financial tracking and analysis.

However, keep in mind that you can only open a business bank account if you have an EIN. While you can get an EIN as a sole proprietor, there are more benefits to getting one if you choose a different business structure, like an LLC or S Corp. Once your account is set up, you’ll have access to various bank cards tailored for business use, which can help streamline your financial operations and provide additional benefits like cash back on business purchases.

2. Digitize to automate record-keeping

One of the easiest ways to easily organize a stack of important papers is to go digital. That way you’ll be able to easily access all documents and quickly find needed information.

And there are two ways to do it:

- Use dedicated software for accounting and record-keeping that will let you store digital business receipts with receipt details, and important documents such as invoices, tax records, and others. For professional invoicing, you can make use of an online invoicing app.

- Or create a dedicated space in your digital environment (it might be a flash drive, cloud storage, or a separate folder).

What’s more, you can get rid of all the papers after the required time of 3 years and still have all documents and receipts at hand. You never know when you’ll need that receipt from a lunch with a client from a year ago, or the invoice for your services.

3. Organize paper receipts

According to the IRS (Internal Revenue Service), small business owners or self-employed are required to keep the records of company expenses for the period of 3 years. To stay legally compliant and avoid legal problems, it’s a good idea to organize all your paper receipts until you don’t need them.

Firstly, because you may be subject to a financial audit. Secondly, because as a business owner you may need proof of expense for your clients.

It’ll be easier to track bills with an organized system. You can use simple envelopes, have a separate drawer in your cabinet, or use an organizer such as binders, or file folders. Or you can choose to use a digital receipts tool to ensure all of your receipts can be found in one place.

Adding labels with a client, category, type of expense, date, and other information will make it easy to store receipts and improve searching.

4. Benchmark your business

You have to understand accounting ... It's the language of business. — Warren Buffett

One trick to staying financially healthy is to measure your performance against other businesses. However, this may not always be accurate since every business is different and operates on various terms.

The authors of an article for Harvard Business Review suggest looking for sources that would help you compare your business to competitors: “Annual reports and other easily available publications can uncover gross indicators of efficient operation. Universally recognized measures like ROA, revenue per employee, inventory turns, and percent SG&A expenses will help identify the well-managed companies.”

Since you want to benchmark expense tracking, you should focus on the financial aspects of owning a business. Make research on how other businesses in your industry and niche are performing, what their financial goals are, what tools people use to track, manage, and optimize expenses, and what are the common practices.

You can talk to a consultant to learn about the trends and objectives. Or you can use the Business Expenses Survey (BES) provided by the US Census Bureau as a cheat sheet. It’s an official document that covers statistics on operating expenses in many industries.

5. Use software

Another way to effectively track expenses is to use expense tracker apps.

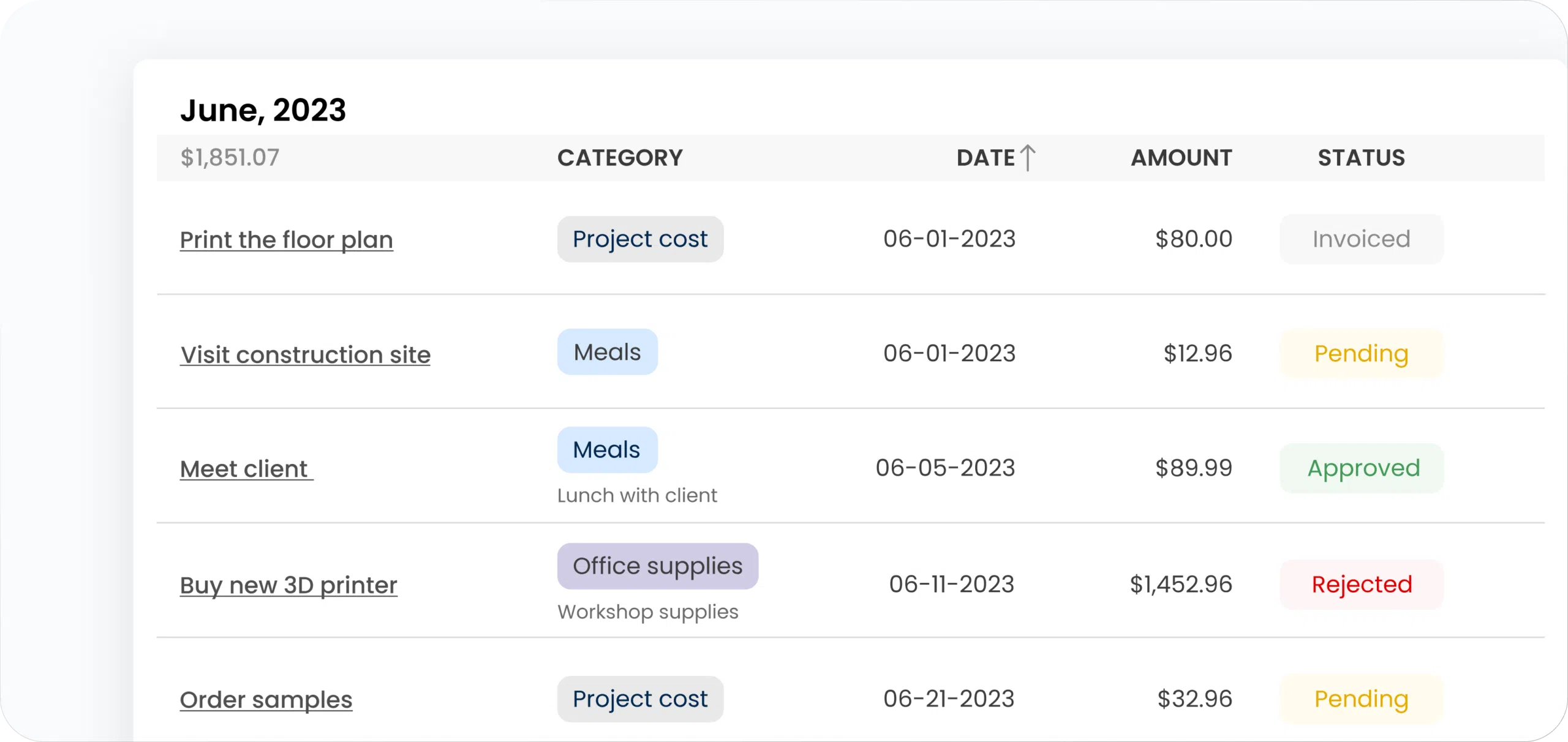

In this context, TimeCamp has a peculiar usage. You can track expenses using the “Expenses” feature, by recording costs as they occur, or by logging the time spent on a task and multiplying the hours by the cost per hour.

Having the right software will ensure smooth expense management:

- It’ll work as a database for all the information about expenses and financial aspects of your business.

- You’ll be able to see your spending habits and common financial patterns.

- You’ll have a clear picture of the company’s income and expenses, also you’ll know the exact cost of an employee.

- The right app will automate work and optimize redundant processes; that way, you’ll have less paperwork.

Additionally, many of the apps will let you scan receipts so you can digitize important documents, store transaction data, monitor statistics, and more.

6. Categorize expenses

Categorizing expenses can save you a lot of trouble when it comes to storing or searching for the needed data. Especially since much of your spending is eligible for expense deductions. Classifying costs will make it easier to distinguish deductibles from other costs. It’s important to understand how to organize expense categories.

👉 You can find more details about it in the IRS Publication 535 (2020), Business Expenses.

Some of the categories you may find helpful include travel expenses, office supplies, daily expenses, or non-business purposes.

However, for tax deductions set by the above-mentioned Publication 535, you’ll need specific categories:

- Cost of goods sold (the cost of products or raw materials, including freight, storage, direct labor, and factory overhead).

- Capital expenses (business start-up costs, business assets, improvements).

- Personal expenses (here, you can only deduct an expense for something that is used partly for business and partly for personal purposes, for example, when you use part of your home for business purposes).

You can also deduct an expense depending on the accounting method. There are two basic methods—accrual accounting (when spendings are recorded when a transaction takes place, not when the payment is received), and cash payments.

So with the appropriate category for all business costs, you ensure compliance with the tax laws and the main financial standards using automated accounting software.

You can also use the expertise of a virtual CFO for small business to further enhance your ability to manage and optimize expenses efficiently.

7. Check regulations

To stay up-to-date and compliant with federal rules and laws, always make sure you’re following the latest guidelines.

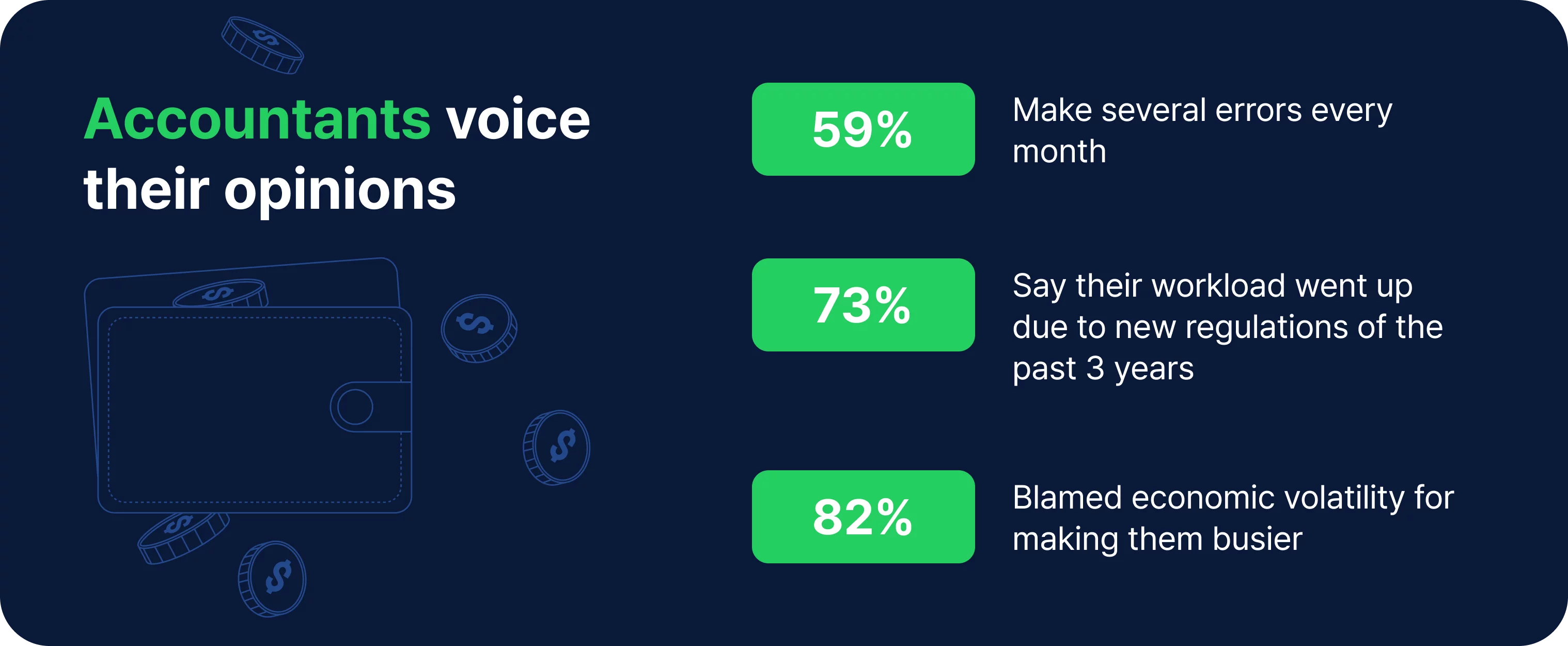

You can hire an accountant or financial advisor to help you prepare financial statements. If, for example, you are planning to get car insurance, it’s best to talk with such a person first because they will clear all your doubts and guide you through the process of getting insured at a fair price.

8. Use calculators

Sometimes, to make sure your calculations are accurate and you’re on track with a budget, it may be enough to do some counting.

There are many calculators that can help you track your expenses. TimeCamp has prepared the most commonly used ones for you.

- Profit margin calculator: to check whether you’re not losing money on low product prices.

- ROI calculator: to measure if you’re gaining a return from an investment.

- Overtime calculator: to count overtime pay and always pay or get paid the right amount of money.

The Best Expense Tracker Apps

Whether you work as a freelancer, small business owner, or in a large company, with the right expense tracker you can reach your financial goals and help your business grow.

Different tools are aimed at self-employed and businesses that hire employees. To help you choose the right app to keep track of expenses, here’s a list of top tools.

1. TimeCamp

Best for: expense management and business budgeting

TimeCamp is a time tracker with an expense tracker suitable for all businesses in all industries. It allows you to keep track of all the company’s expenses in one place.

It’s a good app for tracking employee time for accurate monthly bills. Its automation features help save money and optimize workflow.

Key features include:

- Tracking billable time and non-billable time. You can set different billing rates for different users or projects.

- The expense module lets you monitor all project-related expenditures.

- Set reminders to alert you when the budget exceeds predefined limits. This will help you stay on top of your finances and avoid unexpected costs.

- You can generate detailed reports tailored to your needs, providing valuable insights into time usage, project progress, and financial health.

- Timesheets with approvals give you insight into how your team works.

- Invoicing.

- Budget planning.

- Integrations with other tools for productivity and finances.

Other essentials that can help you stay organized include project and task management, automated time tracking, attendance, productivity monitoring, notifications, and more.

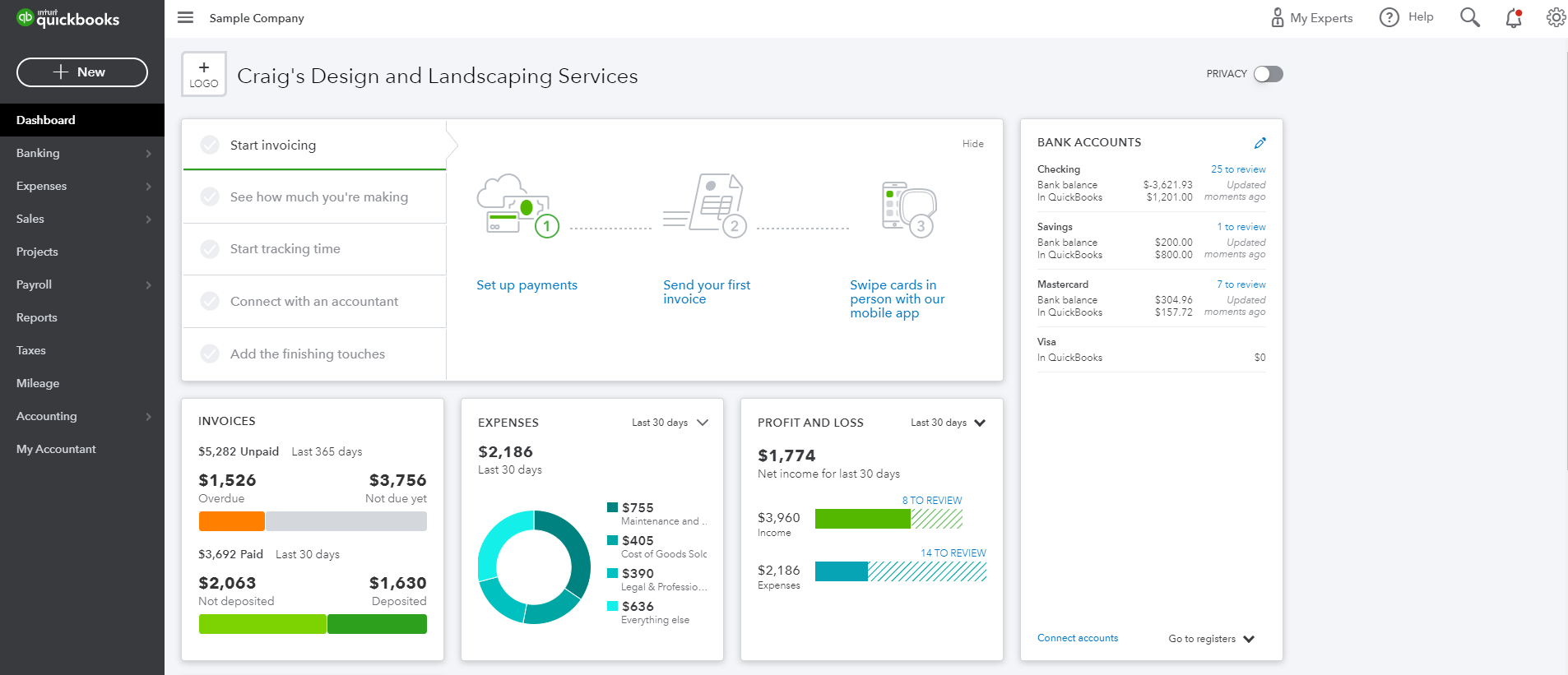

2. QuickBooks Online

Best for: advanced accounting and bookkeeping with tax management features

QuickBooks Online is accounting software that offers a package of utilities to help small business owners track and manage expenses. It’s focused solely on the financial aspects of running a company.

It’s a robust system that offers many ways to track expenses. You get a dashboard, with all your linked credit cards and bank accounts, that gives you insight into how your business is doing. This accounting software has many functions that let you manage finances, payroll, and track bills with different expense trackers. Moreover, linking your QuickBooks data to Google Sheets is one of the best ways to analyze data more flexibly.

Here are the main functionalities:

- Create customized invoices.

- Upload receipts.

- Add tags, label transactions.

- Import transactions from your bank accounts.

- Manage sales tax, employee, and other expense reports.

- Manage taxes in one place.

- Track mileage with the mobile app.

- Administer cash flow.

- Manage and process payroll.

[acfoption fieldname=”pricing”]

QuickBooks Online is an advanced business expense tracker app. However, if you’re not familiar with accounting and bookkeeping, you may find it difficult to learn how to use the app.

Pricing: QuickBooks may be expensive for starting and small companies as the plans start at $30. For freelancers, the plan is $20.

👉 Check our QuickBooks time tracking integration!

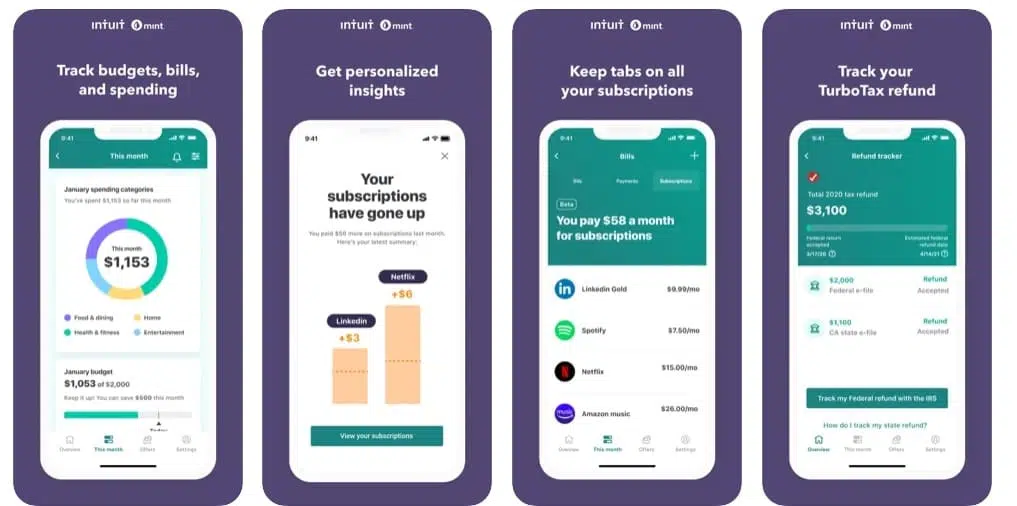

3. Mint

Best for: personal expense tracking

Mint

is an expense tracker app dedicated to individuals. For this reason, it’s best for freelancers and people working solo. It offers basic accounting software features so you can control personal spending.

Adding your cash, credit cards, investments, and bills allows for keeping track of all bankings. You can set financial goals and get insights into them to stay on track. Mint also reminds you about due dates for payments.

This expense tracker app is best for simple expense tracking for people who’re either starting a business or want a simple solution.

Pricing: Mint is free. The company makes money from carefully selected partner offers that could help take your money further.

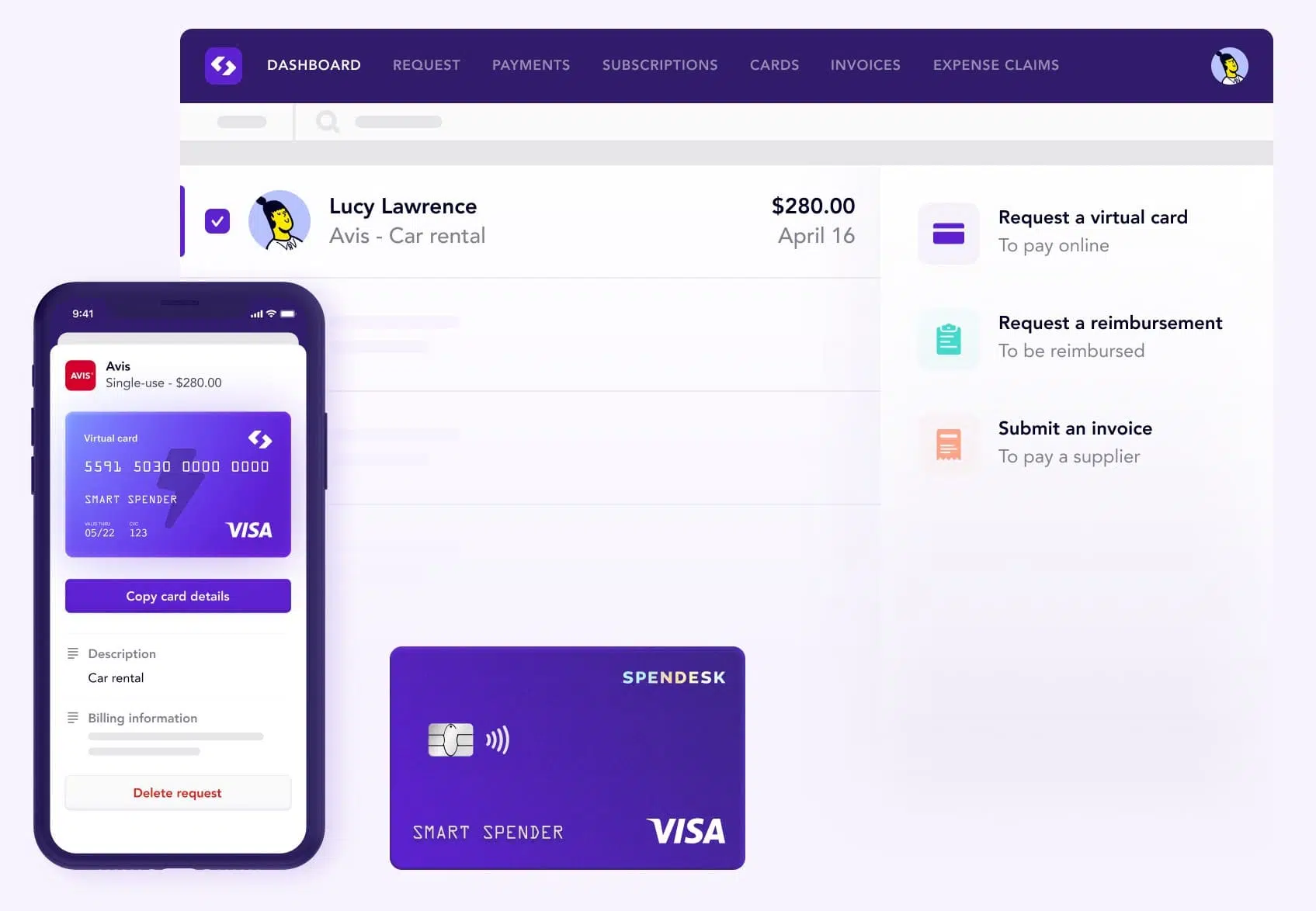

4. Spendesk

Best for: spend management with accounting software features

Spendesk

combines features of accounting software and an expense tracker app. It helps to control the budget, pay easily for different kinds of transactions, and track everything your company spends.

Main features include the following:

- Spend control—you can control what your employees are spending money on.

- Real-time data on all transactions.

- You can block users from spending too much money.

- Reimbursement for other spending (travel, mileage, meals, etc.).

- Up-to-date VAT calculations and receipt collection.

- Virtual debit cards and physical cards.

- Invoice management.

Spendesk allows you to save time and money on administrative procedures and find the best ways to increase business income.

Pricing: custom pricing; not specified by the vendor.

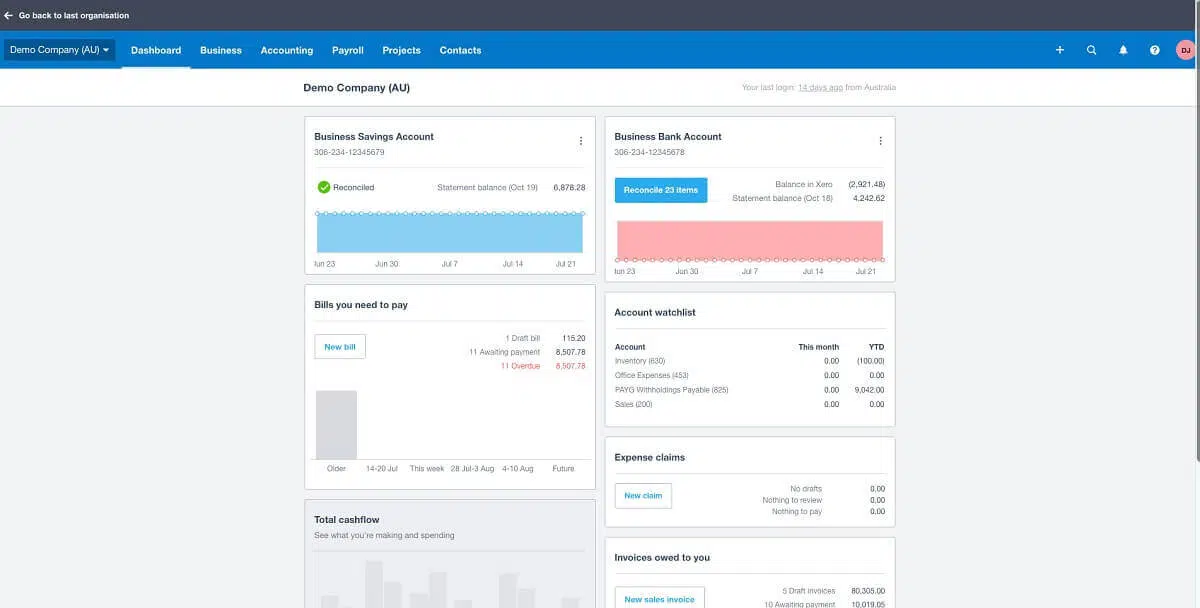

5. Xero

Best for: businesses with feature-rich accounting software needs

Xero

is accounting software packed with helpful functionalities. It’s designed specifically to handle accounting services.

Xero’s online accounting platform provides the foundation on which you can build a complete business solution for tracking expenses. It connects you with your bank, accounting tools, accountant, payment services, and third-party apps, so everything is securely available at any time on any device.

Here’s what you can do with Xero:

- Collaborate with clients and share information, reports, and other data from your account.

- Track and pay bills.

- Simplify employee expense claims. Capture costs, submit, approve and reimburse claims, and view spending.

- Connect your bank to Xero and set up bank feeds.

- Accept online invoice payments and get paid up by connecting to Stripe, GoCardless, and others.

- Track project profits – prepare quotes and estimates, use a built-in timer, monitor profit margins.

- Keep the full contact history, and inventory of your items, including digital receipts.

- Automatically calculate sales tax on transactions, and use reports to prepare sales tax returns, tax deductions, and all documents for tax time.

🧩 Check our integration with Xero and boost your financial performance!

Pricing: You can access all Xero features for 30 days, then decide which plan best suits your business. Pricing starts at $15 per month.

To Wrap It Up

With the right expense tracker apps, you can easily monitor and manage all financial aspects of your business. Additionally, modern expense trackers support double-entry bookkeeping, which is important to stay compliant with the law and keep the balance sheet correct.

What are your favorite best expense tracker apps? How do you keep track of expenses and income? Let us know in the comments!